Bibliography

2.1 Bullet #19:

“Clean Energy and Pollution Reduction Act Senate Bill SB350 Study”, a report of the California Independent System Operator (CAISO), July 12, 2016; pages 17 & 91.

See: http://www.caiso.com/Documents/SB350Study-StakeholderComments-ISOResponses-May24-25_2016.pdf

2.2 Bilateral markets:

“Senate Bill 350 Study: The Impacts of a Regional ISO-Operated Power Market on California”, an aggregated report of the CAISO, July 8, 2016; Volume 3, p. 9 & Volume 5, pp. 61-64.

See: http://www.caiso.com/Documents/SB350Study_AggregatedReport.pdf

2.3 Storage and hydro

“SB 350 Study: The Impacts of a Regional ISO-Operated Power Market on California Analysis and Results”, a presentation to the Joint State Agency Workshop on the Proposed Regionalization of the Independent System Operator, Sacramento, CA; The Brattle Group, Energy and Environmental Economics, Inc., Berkeley Economic Advising and Research, LLC, and Aspen Environmental Group; July 26, 2016; slide 21.

See: https://www.caiso.com/Documents/Presentation-SenateBill350Study-Jul26_2016.pdf

2.4 RPS requirements

“SB 350 Study: The Impacts of a Regional ISO-Operated Power Market on California Analysis and Results”, a presentation to the Joint State Agency Workshop on the Proposed Regionalization of the Independent System Operator, Sacramento, CA; The Brattle Group, Energy and Environmental Economics, Inc., Berkeley Economic Advising and Research, LLC, and Aspen Environmental Group; July 26, 2016; slides 13, 36, and 129-138.

See: https://www.caiso.com/Documents/Presentation-SenateBill350Study-Jul26_2016.pdf

2.5 Assumed solar costs

“SB 350 Study: The Impacts of a Regional ISO-Operated Power Market on California Analysis and Results”, a presentation to the Joint State Agency Workshop on the Proposed Regionalization of the Independent System Operator, Sacramento, CA; The Brattle Group, Energy and Environmental Economics, Inc., Berkeley Economic Advising and Research, LLC, and Aspen Environmental Group; July 26, 2016; slide 30.

See: https://www.caiso.com/Documents/Presentation-SenateBill350Study-Jul26_2016.pdf

2.6 “Free transmission”

“Clean Energy and Pollution Reduction Act Senate Bill SB350 Study: Stakeholder Comment and ISO Responses from May 24 – 25, 2016 Preliminary Results Meeting”, a report of the CAISO, July 12, 2016; p. 30.

See: http://www.caiso.com/Documents/SB350Study-StakeholderComments-ISOResponses-May24-25_2016.pdf; and

“SB 350 Study: The Impacts of a Regional ISO-Operated Power Market on California Analysis and Results”, a presentation to the Joint State Agency Workshop on the Proposed Regionalization of the Independent System Operator, Sacramento, CA; The Brattle Group, Energy and Environmental Economics, Inc., Berkeley Economic Advising and Research, LLC, and Aspen Environmental Group; July 26, 2016; slide 108.

See: https://www.caiso.com/Documents/Presentation-SenateBill350Study-Jul26_2016.pdf

2.7 Mandated energy efficiency

“SB 350 Study: The Impacts of a Regional ISO-Operated Power Market on California Analysis and Results”, a presentation to the Joint State Agency Workshop on the Proposed Regionalization of the Independent System Operator, Sacramento, CA; The Brattle Group, Energy and Environmental Economics, Inc., Berkeley Economic Advising and Research, LLC, and Aspen Environmental Group; July 26, 2016; slide 28.

See: https://www.caiso.com/Documents/Presentation-SenateBill350Study-Jul26_2016.pdf

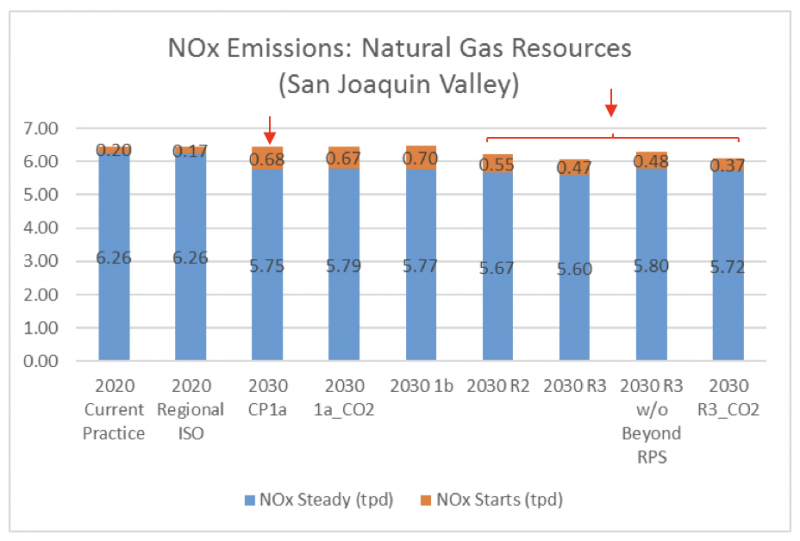

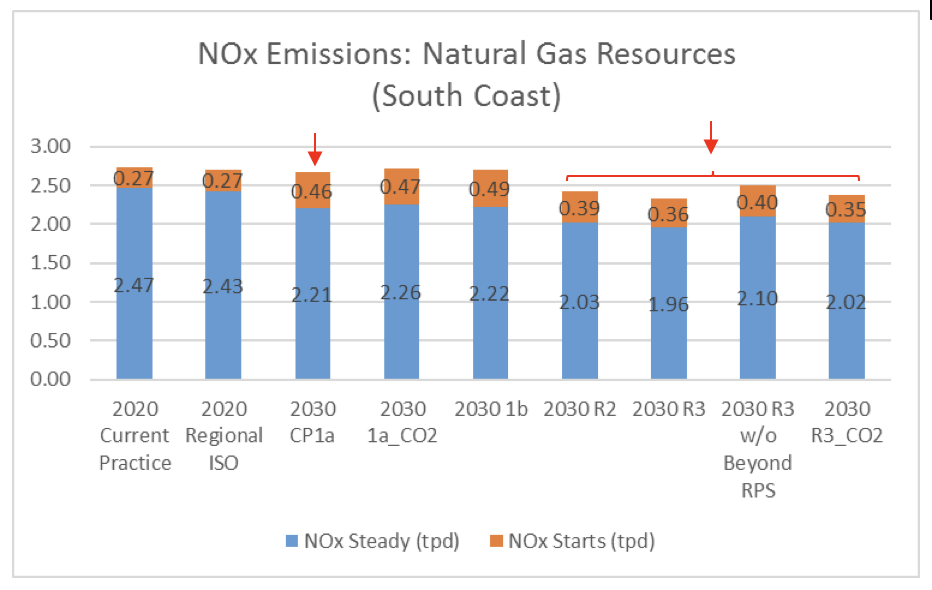

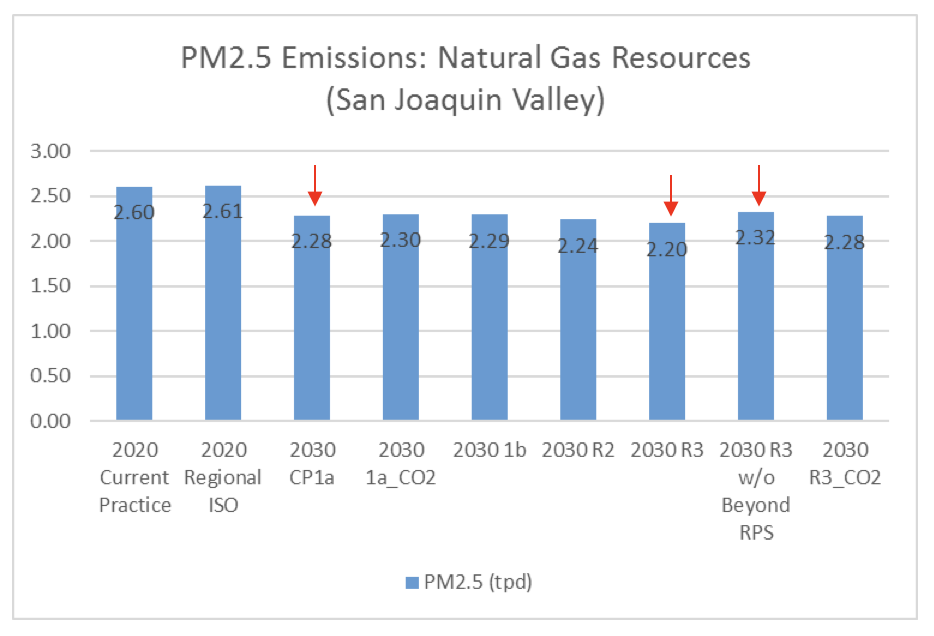

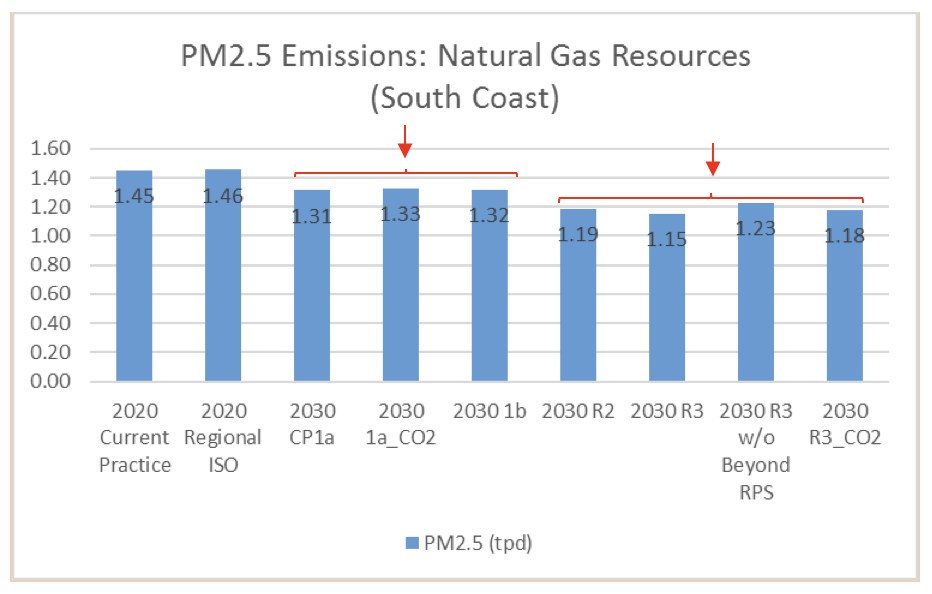

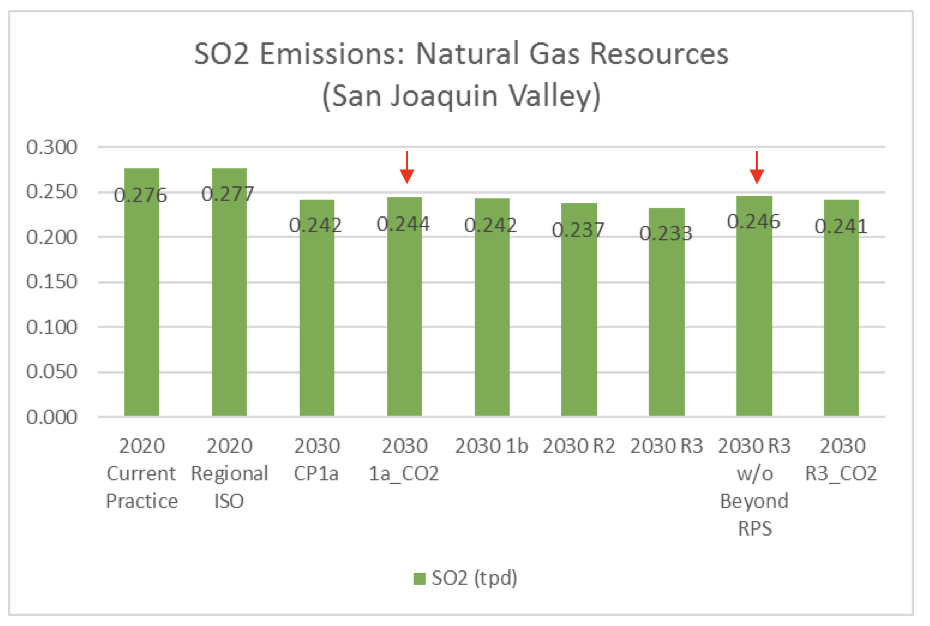

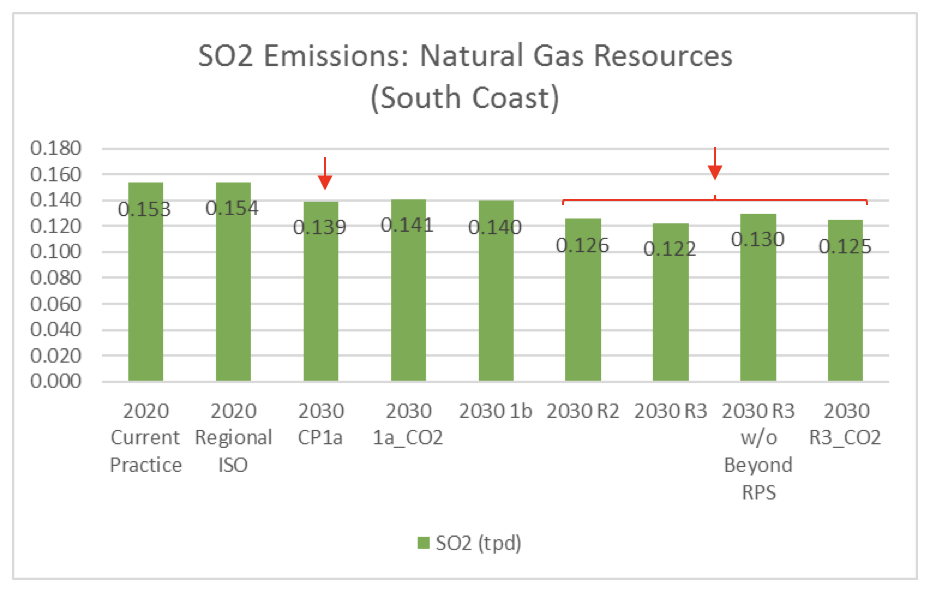

3.2 Gas burning in disadvantaged communities

“Senate Bill 350 Study: The Impacts of a Regional ISO-Operated Power Market on California”, an aggregated report of the CAISO, July 8, 2016; Volume 10, pp. 31-32.

See: http://www.caiso.com/Documents/SB350Study_AggregatedReport.pdf

3.5 GHG emissions

“Energy Imbalance Market: GHG Counter-Factual Comparison (Preliminary Results: January-June 2016)”, a report of the CAISO, August 25, 2016; slides 3-4.

See: https://www.caiso.com/Documents/EIMGreenhouseGasCounter-FactualComparison-PreliminaryResults_Jan-Jun_2016_.pdf

3.7 Transmission of more coal

“2015 Annual Report on Market Issues & Performance”, a report of the CAISO, May 2016, p. 41.

See: http://www.caiso.com/Documents/2015AnnualReportonMarketIssuesandPerformance.pdf

9.4 Latest governance proposal

“Revised Proposal: Principles for Governance of a Regional ISO”, a report of the CAISO, July 15, 2016.

See: https://www.caiso.com/Documents/RevisedProposedPrinciples-RegionalISOGovernance.pdf

Evaluating the costs, benefits and impacts of a Regional System Operator (RSO) on states, utilities and customers is a complex process. The CA Independent System Operator (CAISO), as directed by the CA legislature, has performed significant analysis of these issues. The body of work, known as the SB 350 studies, examined: creation and retention of jobs and other benefits to the CA economy, environmental impacts in CA and elsewhere, impacts in disadvantaged communities, emissions of greenhouse gases and other air pollutants, and reliability and integration of renewable energy resources.

Evaluating the costs, benefits and impacts of a Regional System Operator (RSO) on states, utilities and customers is a complex process. The CA Independent System Operator (CAISO), as directed by the CA legislature, has performed significant analysis of these issues. The body of work, known as the SB 350 studies, examined: creation and retention of jobs and other benefits to the CA economy, environmental impacts in CA and elsewhere, impacts in disadvantaged communities, emissions of greenhouse gases and other air pollutants, and reliability and integration of renewable energy resources.