Table of Contents for this brief:

- Background

- Independent Board

- Key Issues

- Principles and Strawman Proposals

Governance

This informational brief is one in a series developed by Western Clean Energy Advocates to increase the understanding of issues related to a change from the California Independent System Operator (CAISO) governance structure to a new structure for a Regional System Operator (RSO). This paper describes: the current CAISO system of governance; primary considerations (issues of concern expressed by stakeholders); proposals that have been put forward by different parties; and principles that can guide development of the RSO. This paper only deals with the structure of the entity that has designated decision-making authority.

Creating a new governing body that can be representative of and responsive to a wide variety of interests is challenging. Fortunately, the process will be informed by other similar efforts.

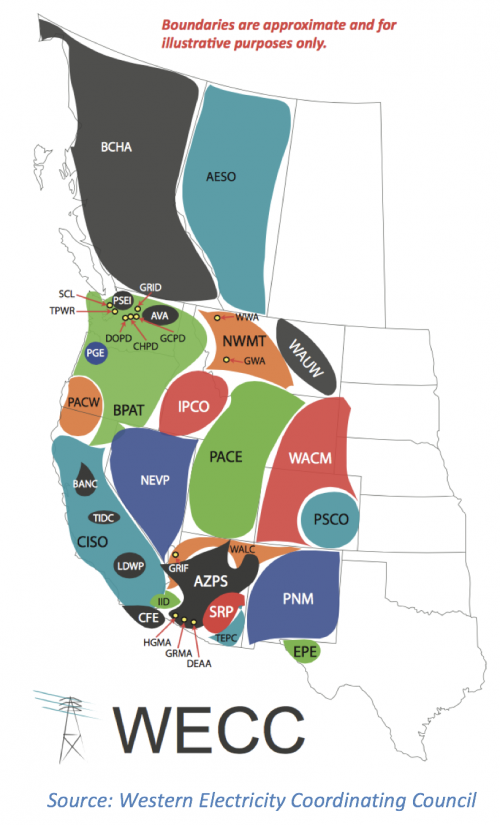

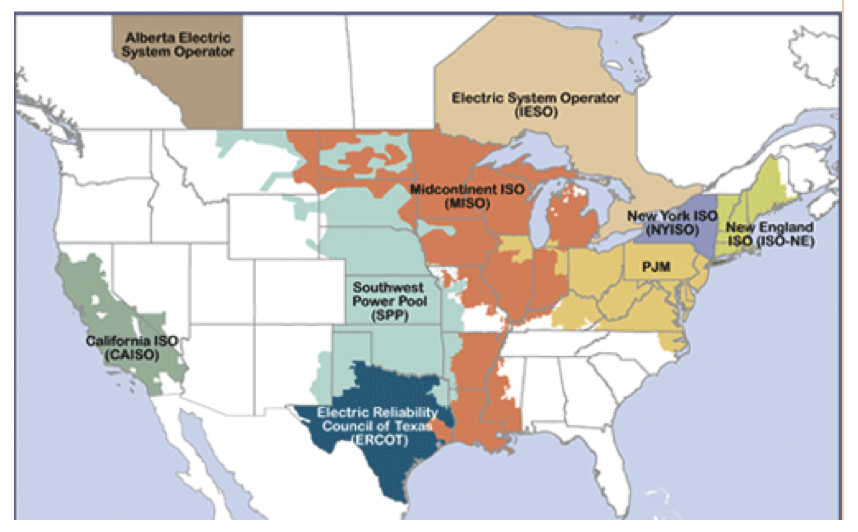

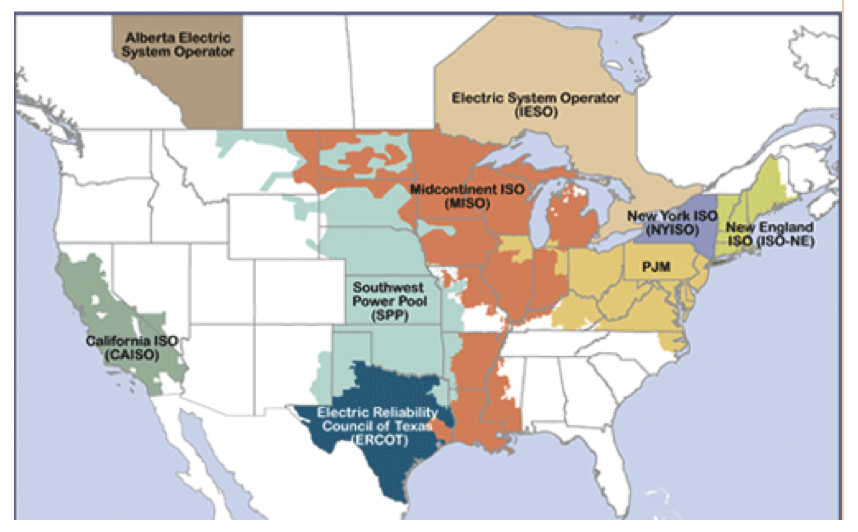

- There are seven RTOs[1] in existence in the U.S. and many more around the world. These existing structures vary in size and scope and provide a template for development of an RSO in the Western U.S.

- Over the past three years, a structure of governance has been designed for operation of the regional Energy Imbalance Market (EIM). To develop this new EIM governance framework, the CAISO created an extensive stakeholder process and empaneled a Transitional Committee tasked with developing a new governing structure and a methodology to select its first directors.

Background

Background

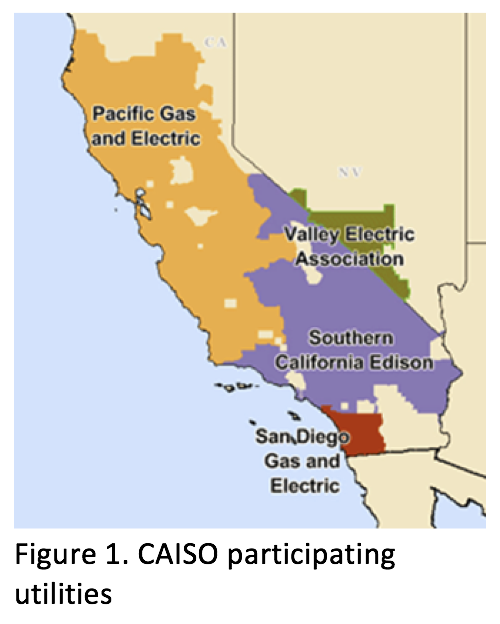

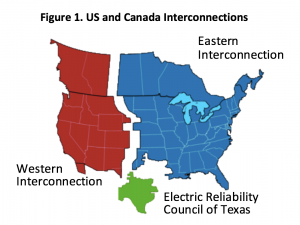

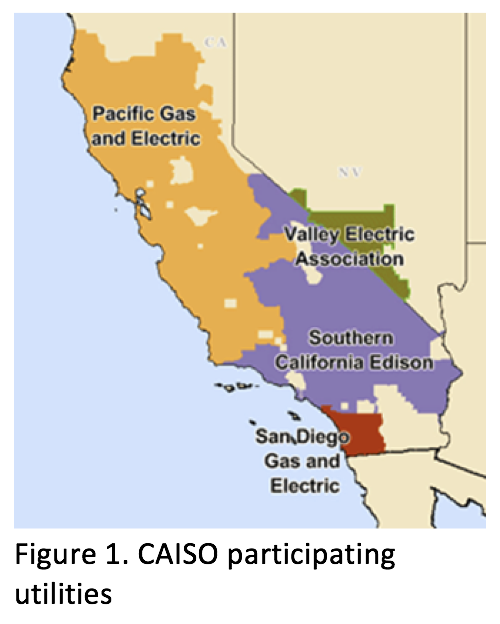

The California Legislature authorized the CAISO[2] in 1996. It is a 501(c)(3) non-profit public benefit organization incorporated in 2001 to coordinate operation of the transmission system for entities within California. The following balancing authorities (BAs) are market participants of the CAISO: San Diego Gas and Electric, Southern California Edison, Pacific Gas and Electric and Valley Electric Association – located in Nevada. (see figure 1).

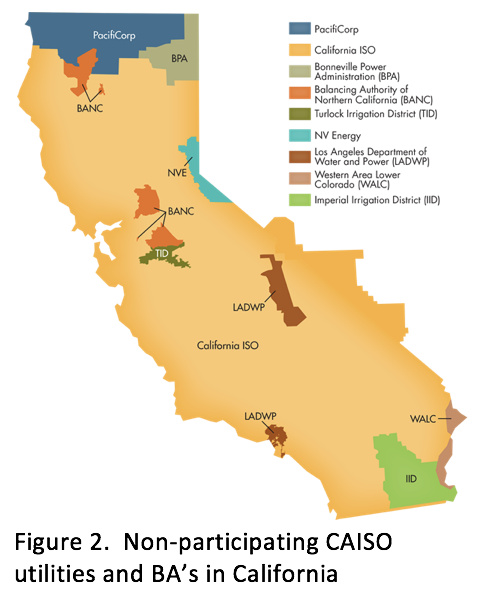

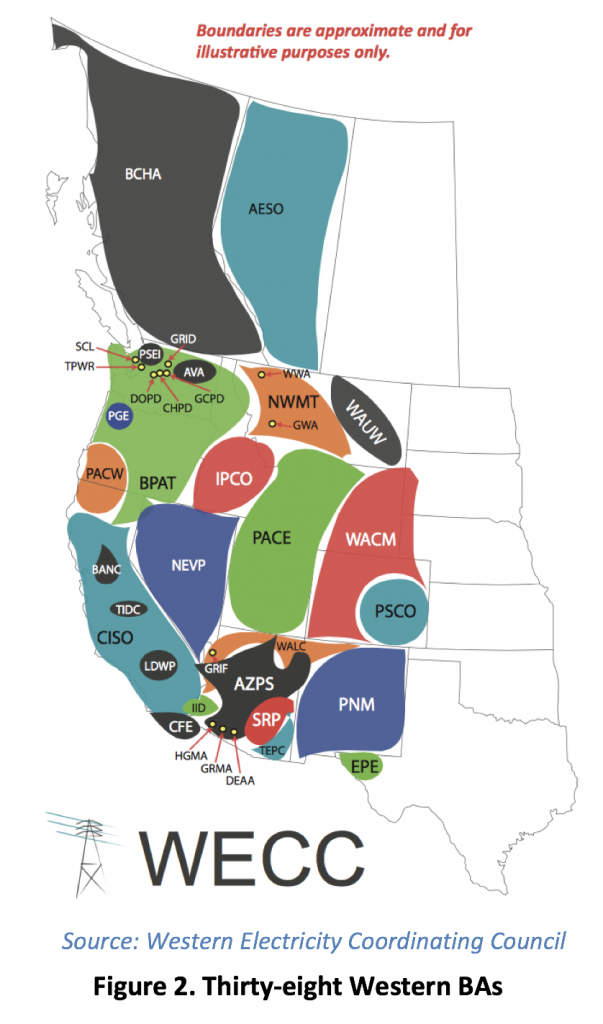

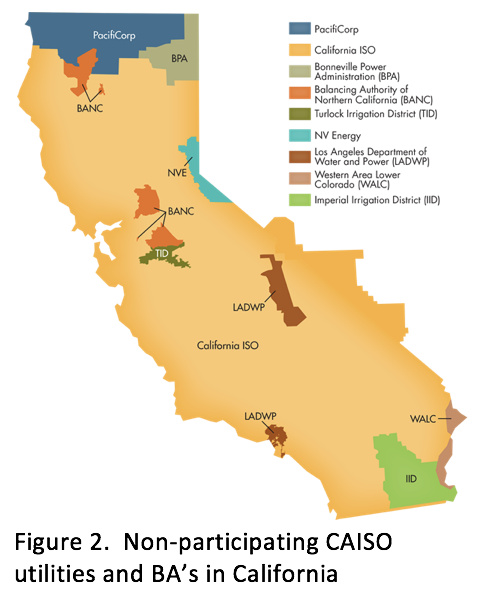

Utilities or Balancing Authorities (BAs) that are in California but not CAISO participants are largely municipal utilities such as Imperial Irrigation District and Los Angeles Department of Water and Power (see figure 2), as well as the federal Western Area Power Administration (WAPA).

The CAISO is responsible for providing power to over 30 million electricity consumers, operating 26,000 miles of transmission, managing the flow of electricity for about 80 percent of California and a small part of Nevada, about 35 percent of all electric load in the Western Interconnection.

A Board of five governors who are appointed by the Governor of California and confirmed by the California Senate governs the CAISO. Unlike many other ISO or Regional Transmission Operators, the CAISO primarily serves one state and its directors are appointed through a political process.

A Board of five governors who are appointed by the Governor of California and confirmed by the California Senate governs the CAISO. Unlike many other ISO or Regional Transmission Operators, the CAISO primarily serves one state and its directors are appointed through a political process.

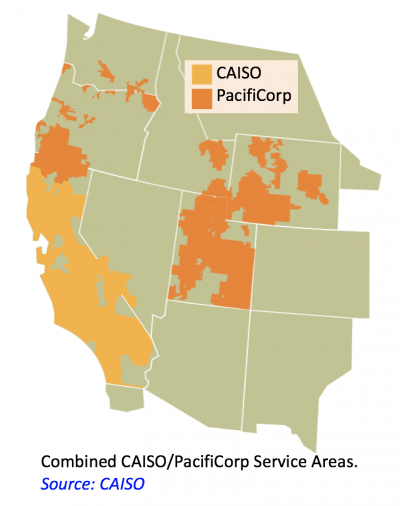

At the current time PacifiCorp (PAC), a utility that operates in six states,[3] is considering merging its day-ahead market operations with the CAISO. In 2015 PAC began participating with the CAISO in the five-minute energy imbalance market (EIM). The financial and efficiency benefits[4] to PAC from participation in this organized market platform encouraged the utility to study full market integration, which is currently underway.

If PAC or BAs in other states merge systems with CAISO, the CAISO would transform to a multi-state organization. As only California-appointed members currently govern the CAISO, adding BAs from other states would necessitate a change to provide an opportunity for representation from other states participating in the regional market.

Independent Board

The rules of the Federal Energy Regulatory Commission (FERC) require that RTOs and ISOs have independent boards. In addition, the CAISO is the only RTO in the U.S. whose board members are appointed by the governor and chosen on the basis of sector representation and experience. All RTO/ISO board appointees – including CAISO’s, are financially independent from any market participant, and they are typically chosen for a specific area of expertise (finance, market operation, etc.).

Key Issues

Broadly speaking, governance is about control of the future RSO and which entities have decision making authority. There are a number of considerations to move from a single-state to multiple-state organization.

Loss of Control of Decision-Making Authority

All states involved in the CAISO – PAC merger are concerned with the possibility that a multi-state regional market will mean that authority their state has to make decisions will be changed or lost. This may include decisions by its utilities, utility regulators or utility boards, legislators, or governors. States, generally, have the following concerns about loss of control:

- Public policy requirements imposed by a legislature, regulatory body or municipal board such as energy efficiency or renewable energy standards, carbon regulations, low-income or disadvantaged community programs, or other directives.

Many states in the West have some form of renewable energy standard. California and Oregon require their utilities to meet 50 percent renewable energy standards, while other states have much lower, or no goal. States with higher goals are worried about losing the ability to maintain these policies, while states with low or no standards are concerned about becoming subject to goals of another state.

- Choice of energy resources built or procured to serve utility customers. Through processes such as Integrated Resource Planning or Resource Procurement utilities choose, and regulators or municipal boards approve coal, natural gas, nuclear, renewable, storage and demand side management purchases. Often times these choices are reflective of a state’s native resources.

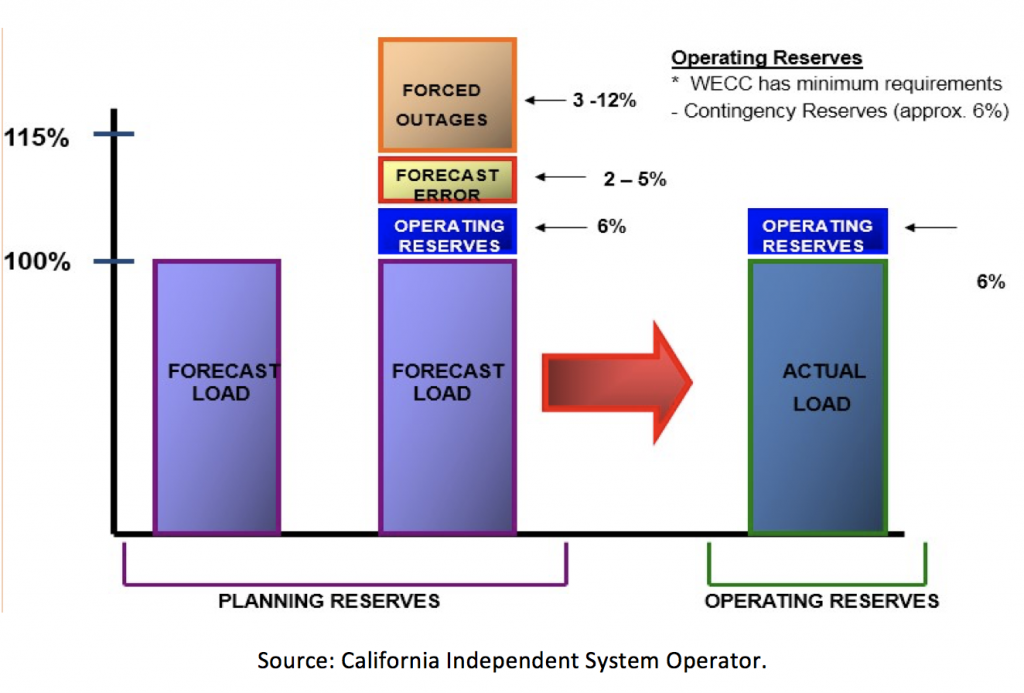

One of the functions of the RSO is to safeguard reliability. This requires it to be able to ensure that adequate amounts of resources and reserves are available on the system to meet load. The CAISO process to determine resource adequacy is unique. States outside of California need assurance that they will continue to have authority for resources acquired by their utilities and paid for by their customers.

- Costs of the system and costs imposed on customers. In moving to a regional entity governed by a board, states and state regulators are concerned that costs to operate the system or build new transmission infrastructure will be out of their hands and in the hands of others.

At the current time states approve the rates utilities charge for the operation of a BA. Similarly, while FERC approves the tariff for bulk transmission, state commissions have an opportunity to review and approve the pass-through charges to customers. Developing an RSO requires new transmission tariffs that must be acceptable to state regulators and decision-makers.

The concern over loss of control is not limited to new states that may participate in the RSO. The state of California policy makers who have control of the current single-state system are worried about how moving to a regional system will affect their decision-making authority. All states want to ensure that they will be able to develop their own resource choices or achieve their own public policy goals and not be subject to a public policy requirement or cost imposed by a different state or new RSO authority.

Building a System for Expansion

Building a System for Expansion

As referenced above, most of the utilities in the U.S. are part of an organized market. RTOs have formed in different fashions. ISO New England was constituted with six states and the geography of the organization and participating utilities has not changed since inception. Alternately, the Southwest Power Pool (SPP) started with a limited number of states and utilities and has grown over time.[5]

Discussions on building a Western RSO are currently limited to the CAISO and PAC states. However, CAISO and participating states recognize that additional participants may join the RSO when it is formed. This has been the experience with the CAISO EIM. Therefore, when developing a governance structure consideration must be given to creating a structure that is adaptable and able to accommodate new market entrants.

Creating a transition to a new governance structure

If the RSO is to move forward it will require changes in the current system of regulation and governance. There are many questions that need to be answered in developing an RSO. These include but are not limited to:

- How large should a governing board be?

- Will states have an advisory or formal input role to the governing board?

- How will stakeholders such as state consumer advocates, low-income, labor or other constituencies be able to provide input to the governing board?

- What expertise is needed on the board?

- How will the board be chosen?

- How long will the terms of board members be?

- Is there any designated period for reviewing of the effectiveness of the board?

- Is there an appeal process on decisions?

Principles and Strawman Proposals

Creating an RSO will require compromise by all stakeholders to develop the most palatable, acceptable new structure. As an initial effort to scope the issues, several stakeholders have developed principles or governance proposals. The following documents have seeded discussion and consideration of a wide range of issues and structures:

Considerations in Establishing a Western Regional System Operator, Prepared for the Hewlett Foundation, April 2016, Ronald J. Binz

Governance of a Regional ISO, Suggestions for Addressing the Political Dilemma,

California Energy Commission Commissioner Michel Florio

Western ISO Governance Principles – Laura Nelson, Utah Office of Energy Development, April 7, 2016

Public Power Statement of Principles on CAISO Market Expansion, March 2016

Stakeholders interested in participating in or following the governance discussion can sign up to receive notifications of developments, meetings and documents here: http://www.caiso.com/Pages/default.aspx

[1] http://www.ferc.gov/industries/electric/indus-act/rto.asp

[2] Chapter 854, 1996 California Legislative Session http://www.leginfo.ca.gov/pub/95-96/bill/asm/ab_1851-1900/ab_1890_bill_960924_chaptered.html

[3] PAC has service territory and customers in the states of California, Idaho, Oregon, Utah, Wyoming and Washington.

[4] The CAISO carefully tracks the EIM for each market participant and reports savings on a quarterly basis. In the most recent report PAC savings were $10.85 million in the first quarter of 2016. https://www.caiso.com/Documents/ISO_EIM_BenefitsReportQ1_2016.pdf

[5] SPP has grown “organically.” The RTO started by providing a limited number of services, which have expanded as member utilities requested additional capabilities.

The California Independent System Operator, or CAISO, is an independent, non-profit organization chartered by the State of California that manages approximately 80 percent of the energy flow in California and a smaller portion in Nevada.

The California Independent System Operator, or CAISO, is an independent, non-profit organization chartered by the State of California that manages approximately 80 percent of the energy flow in California and a smaller portion in Nevada.

The state of California already has a combined area known as the California Independent System Operator, or CAISO. CAISO works as a combined grid operator for most of the independent electric utility providers within California and a small part of Nevada. An important initiative currently underway considers the addition of PacifiCorp’s six-state utility service area

The state of California already has a combined area known as the California Independent System Operator, or CAISO. CAISO works as a combined grid operator for most of the independent electric utility providers within California and a small part of Nevada. An important initiative currently underway considers the addition of PacifiCorp’s six-state utility service area

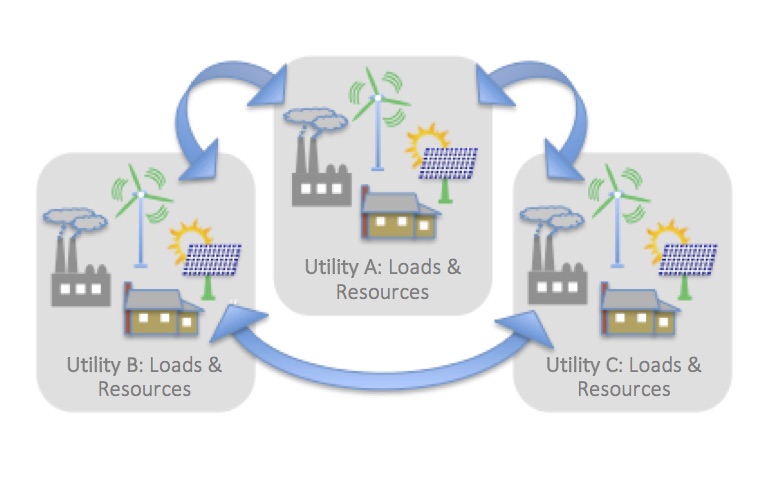

The combining of territories across multiple states into a single RSO will yield many benefits, but also gives rise to some complex issues. Some of these include:

The combining of territories across multiple states into a single RSO will yield many benefits, but also gives rise to some complex issues. Some of these include:

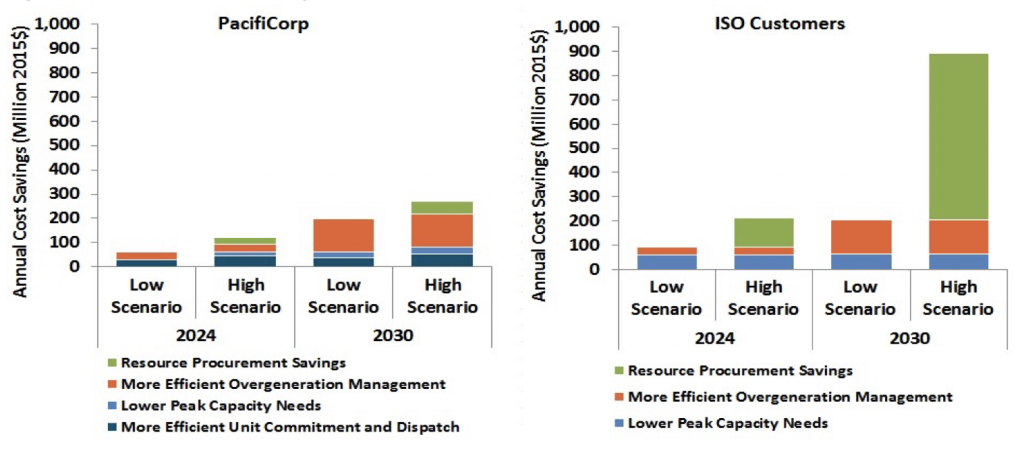

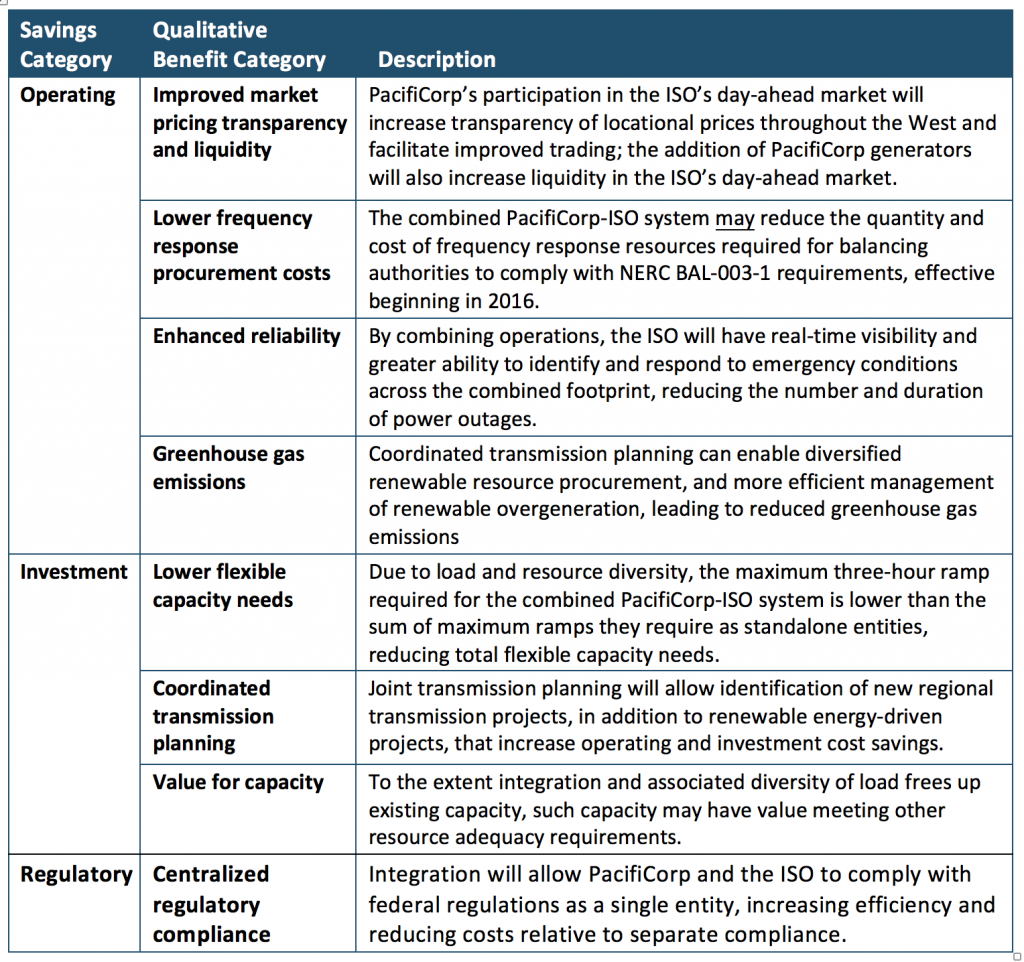

A decision to merge operations with the CAISO by PacifiCorp would allow for a full, day-ahead coordination of the two largest electrical transmission grids in the region and allow customers served by both entities increased access to both clean energy resources and improved system reliability, while lowering overall costs to electricity consumers. This endeavor would necessitate the transformation of CAISO from a single state ISO into a Western Regional System Operator (RSO), with multi-state operation and governance. While other utilities are considering joining the CAISO, PacifiCorp is the first utility to undertake actions toward entry. This document provides a basic understanding of the costs and benefits of establishing the Western RSO.

A decision to merge operations with the CAISO by PacifiCorp would allow for a full, day-ahead coordination of the two largest electrical transmission grids in the region and allow customers served by both entities increased access to both clean energy resources and improved system reliability, while lowering overall costs to electricity consumers. This endeavor would necessitate the transformation of CAISO from a single state ISO into a Western Regional System Operator (RSO), with multi-state operation and governance. While other utilities are considering joining the CAISO, PacifiCorp is the first utility to undertake actions toward entry. This document provides a basic understanding of the costs and benefits of establishing the Western RSO.

Background

Background A Board of five governors who are appointed by the Governor of California and confirmed by the California Senate governs the CAISO. Unlike many other ISO or Regional Transmission Operators, the CAISO primarily serves one state and its directors are appointed through a political process.

A Board of five governors who are appointed by the Governor of California and confirmed by the California Senate governs the CAISO. Unlike many other ISO or Regional Transmission Operators, the CAISO primarily serves one state and its directors are appointed through a political process. Building a System for Expansion

Building a System for Expansion

#1. A cautionary tale: the California energy crisis of 2000 – 2001

#1. A cautionary tale: the California energy crisis of 2000 – 2001