WGG completed and distributed a white paper that profiles several states using Social Cost of Carbon values in utility cost/benefit analysis for regulatory or policy purposes. The document outlines the enactment mechanisms, applications, values, and relevant statutes/rules for each state.

In preparing the brief, WGG worked closely with Washington Utility regulatory and policy staff as they completed the 2017 Integrated Resource Planning (IRP) cycle for the state’s three regulated utilities. The information provided to staff was useful in supporting their finding that utilities should begin using a federal carbon-price formula developed under the Obama administration to measure the broad social costs of carbon-dioxide emissions. The brief has been shared with the WA Commissioners, key commission staff members, key legislators, the Attorney General, and Washington’s consumer advocacy office. WGG also shared the brief with other local and regional clean energy advocates, EDF, and NYU Law School’s Institute for Policy Integrity. WGG intends to continue sharing the information broadly to provide supporting information and regulatory precedent to regulators and decision leaders in other Western states. Oregon advocates have already expressed interest in using the white paper to inform Oregon’s Energy Council as they undertake a rule-making requiring gas-fired power plants to offset more of their pollution through monetary payments to Oregon’s Climate Trust.

Read below or VIEW/DOWNLOAD PDF HERE

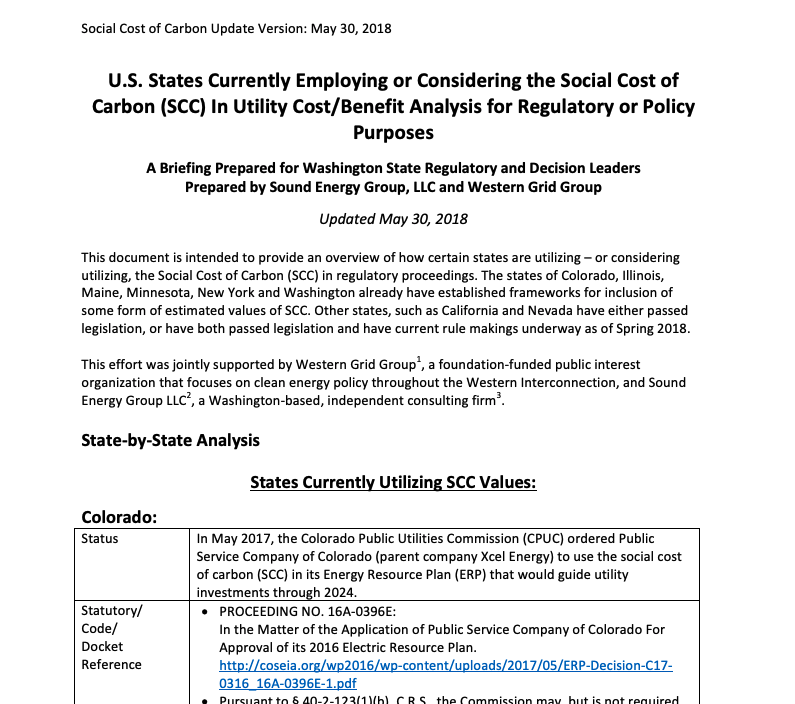

U.S. States Currently Employing or Considering the Social Cost of Carbon (SCC) In Utility Cost/Benefit Analysis for Regulatory or Policy Purposes

A Briefing Prepared for Washington State Regulatory and Decision Leaders

Prepared by Sound Energy Group, LLC and Western Grid Group

Updated May 30, 2018

This document is intended to provide an overview of how certain states are utilizing – or considering utilizing, the Social Cost of Carbon (SCC) in regulatory proceedings. The states of Colorado, Illinois, Maine, Minnesota, New York and Washington already have established frameworks for inclusion of some form of estimated values of SCC. Other states, such as California and Nevada have either passed legislation, or have both passed legislation and have current rule makings underway as of Spring 2018.

This effort was jointly supported by Western Grid Group[1], a foundation-funded public interest organization that focuses on clean energy policy throughout the Western Interconnection, and Sound Energy Group LLC[2], a Washington-based, independent consulting firm[3].

State-by-State Analysis

States Currently Utilizing SCC Values:

Colorado:

| Status | In May 2017, the Colorado Public Utilities Commission (CPUC) ordered Public Service Company of Colorado (parent company Xcel Energy) to use the social cost of carbon (SCC) in its Energy Resource Plan (ERP) that would guide utility investments through 2024. |

| Statutory/

Code/ Docket Reference |

· PROCEEDING NO. 16A-0396E:

In the Matter of the Application of Public Service Company of Colorado For Approval of its 2016 Electric Resource Plan. http://coseia.org/wp2016/wp-content/uploads/2017/05/ERP-Decision-C17-0316_16A-0396E-1.pdf · Pursuant to § 40-2-123(1)(b), C.R.S., the Commission may, but is not required to, include externalities within resource planning considerations. · Authorized under Colorado Code of Regulations, 4 CCR 723-3, rule 3604(k) and 4 CCR 723-3, rule 3611 (g). |

Colorado, continued:

| Context | In Decision No. C17-0316, the CPUC concluded that it had broad authority to include externalities in resource planning considerations and that the Social Cost of Carbon (SCC) estimates published by the federal Interagency Working Group (IWG) convened by President Obama in 2009 should be used by Xcel Energy to quantify the potential cost of externalities from greenhouse gas emissions. Further, it found that using the SCC in portfolio modeling would allow the Commission to “test the robustness of the portfolios and assess the impact to customers of a broader range of costs from carbon emissions.” See: http://policyintegrity.org/documents/Policy_Integrity_Initial_Comments_on_SCC_to_Colo_PUC_013118.pdf |

| SCC Values Used or Proposed | The CPUC ordered that Xcel utilize values established by the U.S. Interagency Working Group on Social Cost of Greenhouse Gases (updated in August 2016) at a 3% discount rate. The ruling explicitly states that Xcel is to use a $43/ton value in 2022 and escalate that to $69/ton in 2050. See: https://www.epa.gov/sites/production/files/2016-12/documents/sc_co2_tsd_august_2016.pdf |

| Application | The ruling applied to sensitivity modeling and comparison of resource alternatives in Xcel Energy’s Phase II IRP analysis. |

| Current Proceedings | The CPUC initiated Proceeding No. 17M-0694E in October 2017 to implement its rules regarding Electric Resource Planning and incorporate its findings of Decision No. C17-0316, including changes to Rules CCR 723-3, 3604(k) and 3611(g). See:

http://policyintegrity.org/documents/Policy_Integrity_Initial_Comments_on_SCC_to_Colo_PUC_013118.pdf |

Illinois:

| Status | In December 2016, the Illinois Legislature passed an energy bill that includes a zero-emission credit (ZEC) program. The bill was modeled after New York’s ZEC mandate that was finalized by the NY Public Service Commission in August 2016. The Illinois law will award qualified nuclear generators one ZEC for each MWh generated and will require utilities to purchase a specified number of ZECs. ZEC prices are pegged to the federal government’s measure of the social cost of carbon and may be adjusted downward by regulators based on forecasted and actual wholesale capacity prices. See: |

| Statutory/Code/

Docket Reference |

Public Act 99-0906, which took effect on June 1, 2017, created a new subsection of the Illinois Power Agency Act: Section 1-75(d-5), known as the Zero Emission Standard. The Illinois Power Agency was directed to create and implement a ZEC procurement plan. Each ZEC represents the environmental attribute value of one ton of avoided carbon emission. See: |

Illinois, continued

| Context | Illinois law does not consider nuclear generating stations to be renewable resources, and they are therefore unable to earn Renewable Energy Credits (RECs). The ZEC Procurement process allows nuclear generators to be compensated for the value they provide in avoiding emissions. Starting in June 2017, regulated IL utilities serving more than 100,000 customers were required to procure ZECs in an amount approximately (rounded to whole ZECs) equal to 16% of the actual amount of electricity delivered by each electric utility to retail customers in the State during calendar year 2014. See: Illinois Power Agency’s Zero Emission Credit Procurement Plan: |

| SCC Values Used or Proposed | The valuation for Illinois’ ZEC program utilizes the U.S. Interagency Working Group on Social Cost of Greenhouse Gases as calculated in the August 2016 Technical Update, utilizing a 3% discount rate. However, the ZECs are valued on a $/MWh basis by converting SCC values from $/ton of CO2 based on state-wide carbon dioxide emissions measured in pounds/MWh for the applicable year. Public Act 99-0906 specified that the initial ZEC value is $16.50/MWh, and that the value will be adjusted according to a Market Price Index, and escalated by an addition $1/MWh each year beginning in 2023. |

| Application | Mandatory procurement of ZECs by regulated utilities, at pricing based on the Social Cost of Carbon. |

| Current Proceedings | None currently known. |

Maine

| Status | Section 1 of Maine’s Act to Support Solar Energy Development, enacted during the 2014 legislative session, deemed that development of renewable resources “in a manner that protects and improves the health and well-being of the citizens and natural environment of the State while also providing economic benefits to communities, ratepayers and the overall economy of the State” is in the public interest. The act also instructed Maine’s PUC to determine the value of the state’s distributed energy resources. See Page 10:

http://policyintegrity.org/files/publications/SCC_State_Guidance.pdf |

| Statutory/Code/

Docket Reference |

LD 1444: ‘An Act To Prohibit Gross Metering’

http://www.mainelegislature.org/legis/bills/bills_128th/billtexts/SP049903.asp

|

| Context | The Value of Solar (VOS) bill was designed to create pricing for distributed solar resources. According to bill sponsor Rep. Sara Gideon, “it acknowledges that net metering works…in the near term…but…at a certain penetration point, net metering will be replaced by a mechanism that is more market sensitive.” |

Maine, continued

| SCC Values Used or Proposed | Maine utilizes the Social Cost of Carbon values established by the Federal Interagency Working Group as updated in 2016. However, because Maine is a member of the Regional Greenhouse Gas Inventory, which bears a carbon price lower than the SCC, for the purposes of calculating the value of the state’s solar energy resources, the state subtracts the RGGI value from the SCC value. |

| Application | Quantification of the value of distributed solar resource pricing. |

| Current Proceedings | Attempts were made by Maine’s Governor Paul LePage to veto the VOS bill, but the most recent attempt was overridden by both Maine’s House and Senate by wide margins in early April 2018. See: https://legislature.maine.gov/LawMakerWeb/summary.asp?ID=280064804 |

Minnesota

| Status | Minnesota state law has long included provisions for assessing the value of damage caused by carbon emissions in the context of externalities. In July 2017, following a ruling by the Colorado Public Utilities Commission that imposed an order for Xcel Energy to utilize SCC values in its Electric Resource Plan, the Minnesota PUC passed a 3-2 decision to significantly raise the cost of carbon to reflect environmental, health, and safety damages. |

| Statutory/Code/

Docket Reference |

· Minnesota State Environmental Rights Act, Sections 116B.01 to 116B.13

https://www.revisor.mn.gov/statutes/?id=116B&view=chapter · Docket No. E999/CI-14-643 In the Matter of the Further Investigation into Environmental and Socioeconomic Costs Under Minn. Stat. § 216B.2422, Subd. 3, Final Order issued January 3, 2018 |

| Context | Minnesota law requires that the Commission, “to the extent practicable, quantify and establish a range of environmental costs associated with each method of electricity generation.” This, in essence, is a requirement to determine the costs imposed on the public by pollution from power plants. |

| SCC Values Used or Proposed | Based on the overall framework of the Federal Social Cost of Carbon, the PUC adjusted its recommended values to a range of $9.05–$42.46 per short ton in 2020. |

| Application | The ruling directs utilities to use the social cost of carbon in conjunction with other external factors when evaluating and selecting resource options in all proceedings before the commission. |

| Current Proceedings | The PUC’s final order, concurring largely with Administrative Law Judge LauraSue Schlatter’s April 2016 findings, was passed on January 3, 2018.

https://www.instituteforenergyresearch.org/analysis/implications-mn-social-cost-carbon-ruling/ |

New York:

| Status | In August 2016 the New York Public Service Commission ruled to place a price on the Social Cost of Carbon, and also to use that price in mandating long-term contracts to support at-risk nuclear power generation. The Commission also adopted a Clean Energy Standard that required 50% renewables and a 40% reduction in greenhouse gas emissions by 2030. Regulated NY utilities began buying zero-emission attributes from upstate nuclear generators at the rate of $17.51 per MWh in April 2017. |

| Statutory/

Code/ Docket Reference |

· CASE 15-E-0302, Matter No. 15-01168:

State of New York Public Service Commission Proceeding on Motion of the Commission to Implement a Large-Scale Renewable Program and a Clean Energy Standard. |

| Context | In 2016, the New York Public Service Commission adopted the Clean Energy Standard to increase renewable generation to 50% of the market by 2030. While working toward that goal, the State found it was necessary to pay nuclear generators through a system of zero-emissions credits (ZECs) as compensation for the value they provide in avoiding emissions. The State found that this would help guard against an increase in pollution if the nuclear generators were to close. See: |

| SCC Values Used or Proposed | Staff’s Responsive Proposal to the standard recommended valuing and paying for the zero-emissions attributes beginning with a formula based upon the U.S. Interagency Working Group’s (USIWG) projected social cost of carbon (SCC). As of April 2017, utilities began buying zero-emission attributes from upstate nuclear generators at the rate of $17.51 per MWh. |

| Application | SCC is used as the basis for compensating New York’s nuclear generators for the value they provide in avoiding emissions, thereby helping the state achieve its 50% Clean Energy Standard.

|

| Current Proceedings | As of April 2018, New York’s Integrating Public Policy Task Force (IPPTF), jointly run by the NYISO and NY Department of Public Service, is evaluating various options for modeling the impacts of carbon pricing on dispatch, resource costs and emissions in its wholesale electricity market.

https://www.rtoinsider.com/social-cost-of-carbon-scc-carbon-pricing-91253/ |

Washington:

| Status | On May 7, 2017, the WA Utilities and Transportation Commission (UTC) issued Acknowledgment Letters in response to the Integrated Resource Plan (IRP) filings of the state’s three regulated utilities (Avista, Pacific Power, and Puget Sound Energy). The Acknowledgement Letters instructed the utilities to begin using a social cost of carbon value in their IRP alternatives analysis to determine the “Lowest reasonable cost” resources as defined in WAC 480-100-238. |

| Statutory/Code/ Docket Reference | Dockets: PSE: UE-160918, UG-160919

Avista: UE-161036, UG-160292 Pacific Power: UE-160353 |

Washington, continued

| Context | Washington State’s Administrative Code, WAC-100-238(2)(b) defines the “lowest reasonable cost” resources to be considered in utility planning to be “…the lowest cost mix of resources determined through a detailed and consistent analysis of a wide range of commercially available sources. At a minimum, this analysis must consider resource cost, market-volatility risks, demand-side resource uncertainties, resource dispatchability, resource effect on system operation, the risks imposed on ratepayers, public policies regarding resource preference adopted by Washington state or the federal government and the cost of risks associated with environmental effects including emissions of carbon dioxide.” The UTC’s May 7th decision affirms that the Commission finds the Social Cost of Carbon to be a reasonable means of quantifying the “cost of risks…including emissions of carbon dioxide”. |

| SCC Values Used or Proposed | The UTC specified that the SCC values to be utilized in future IRPs “should come from a comprehensive, peer- reviewed estimate of the monetary cost of climate change damages, produced by a reputable organization. We suggest using the Interagency Working Group on Social Cost of Greenhouse Gases estimate with a three percent discount rate”. |

| Application | “Lowest Reasonable Cost” resource determination in electric and gas Integrated Resource Planning. |

| Current Proceedings | WA has a current rule making open to consider potential changes to existing rules to reflect technological change and current best practices in WAC 480-100-238, Integrated Resource Planning (Electric); WAC 480-90-238, Integrated Resource Planning (Natural Gas); and WAC 480-107, Electric Companies – Purchases of Electricity from Qualifying Facilities and Independent Power Producers and Purchases of Electrical Savings from Conservation Suppliers. See:

https://www.utc.wa.gov/docs/Pages/DocketLookup.aspx?FilingID=U-161024 |

States with Current SCC Legislation and/or Rulemakings Underway:

California:

| Status | On March 14, 2018, a California Public Utilities Commission (CPUC) ALJ issued a ruling seeking comment on CPUC Energy Division staff’s proposal to adopt a Societal Cost Test (SCT) for bid evaluation in competitive solicitations for Distributed Energy Resources (DERs). This rule making is the third of a four-phase proposal initiated in 2015. The staff’s most recent proposal recommends adoption of the SCT and modified Total Resource Cost (TRC) and Program Administrator Cost (PAC) tests, and further recommends the greenhouse gas adder for the Societal Cost Test based upon SCC values established by the federal Interagency Working Group. |

| Statutory/ Code/

Docket Reference |

Rulemaking 14-10-003:

Order Instituting Rulemaking to Create a Consistent Regulatory Framework for the Guidance, Planning and Evaluation of Integrated Distributed Energy Resources. http://docs.cpuc.ca.gov/PublishedDocs/Efile/G000/M212/K023/212023660.PDF |

California, continued

| Context | The CPUC staff’s proposal to develop and implement a Societal Cost Test is intended to develop fair practices and methodologies for competitive procurement of DERs, and to better enable the Commission to make resource allocation decisions that maximize social welfare. |

| SCC Values Used or Proposed | The proposed greenhouse gas adder is the set of high impact values established by the U.S. Interagency Working Group on Social Cost of Greenhouse Gases (updated in August 2016) at a 3% discount rate.

https://www.epa.gov/sites/production/files/2016-12/documents/sc_co2_tsd_august_2016.pdf |

| Application | Determination of the greenhouse gas adder values to be used in the proposed Societal Cost Test. |

| Current Proceedings | Comments to ALJ Hymes’ Rulemaking 14-10-003 were due to the CPUC by April 20th, with reply comments (to other commenters) due by May 7th. |

Nevada

| Status | On March 26, 2018, the Public Utilities Commission of Nevada (PUCN) issued a draft regulation implementing Senate Bill 65. The legislation, which passed during the 2017 Legislative session, made changes to NV’s IRP statute that compels (rather than allows) the Commission to give preference to supply resources that “…Provide the greatest economic and environmental benefits to the State…(and among other requirements) reduce customer exposure to the price volatility of fossil fuels and the potential costs of carbon.” The legislation did not specify the inclusion of SCC, but the more specific proposed regulation requires utility IRPs to calculate the environmental costs of its alternatives, including SCC based on federal IWG models. |

| Statutory/ Code/

Docket Reference |

· Senate Bill 65: Nevada Utility IRP statute modifications (BDR 58-167). See: https://www.leg.state.nv.us/App/NELIS/REL/79th2017/Bill/4712/Overview

· Proposed Regulation R060-18, Docket Number 17-07020. See: http://pucweb1.state.nv.us/PDF/AxImages/DOCKETS_2015_THRU_PRESENT/2017-7/29622.pdf · IRP Statute (NRS 704.746), See: |

| Context | The proposed implementing regulation clears certain ambiguities in Nevada’s IRP statute and provides specificity of the PUCN’s authority to select the IRP alternatives put forward by regulated utilities that include supply resources that provide economic and environmental benefits to the state, as well as those resources that mitigate the risk of the price volatility of fossil fuels and the potential cost of carbon. The proposed rule also amends Nevada’s Administrative Code (NAC 704.9359) to include the social cost of carbon in evaluating “environmental costs to the state” of proposed supply resources. |

Nevada, continued

| SCC Values Used or Proposed | The regulation specifies that utilities utilize SCC values established by the U.S. Interagency Working Group (IWG) on Social Cost of Greenhouse Gases (updated in August 2016). It does not specify a particular discount rate, but does require utilities to calculate the present worth of societal costs for each alternative plan by adding SCC values to their projected costs of carbon abatement. It also allows regulated utilities to offer an alternative SCC evaluation (in addition to the IWG values) provided that the alternative analysis “utilizes best available science and economics and is of equivalent quality to the IWG Model, and provided that the utility includes support in its filing for use of such alternative methodology”.

https://www.epa.gov/sites/production/files/2016-12/documents/sc_co2_tsd_august_2016.pdf |

| Application | SCC values are to be used in determining “environmental costs to the state” of each alternative IRP scenario, as defined in NRS 704.746. |

| Current Proceedings | On May 1, 2018, Nevada’s Legislative Counsel Bureau (LCB) advised the PUCN that before proceeding further with an additional workshop on the proposed rule, the Commission must evaluate potential economic impacts of the proposed rule to small businesses. The PUCN will prepare its economic analysis report and deliver it to LCB no later than the last open meeting of the PUCN in June 2018. See:

http://pucweb1.state.nv.us/PDF/AxImages/DOCKETS_2015_THRU_PRESENT/2017-7/30200.pdf |

[1] See Western Grid Group: https://www.westerngrid.net

[2] Sound Energy Group contact: Kate Maracas, kmaracas@comcast.net, (360) 688-1105

[3] Assistance and references also provided by the Regulatory Assistance Project, Rebecca Wagner Strategies (Nevada), Environmental Defense Fund, New York Law School’s Institute for Policy Integrity, and other references as cited.

Comments are closed