WGG commissioned a report by Synapse Energy Economic, Inc. to estimate the benefits of the newly formed regional Energy Imbalance Market. The report was commissioned to illuminate all benefits – financial savings as well as reliability improvements – resulting from utilities participating in this market platform. The report will be used to encourage utilities and regulators to join the EIM as soon as possible to capture customers’ savings, reduce the cost of renewable energy integration and improve reliability.

The report presents a new method and results for quantified reliability benefits by estimating the Value of Lost Load (VOLL) applied to the September, 2011 Southwest outage. The study also poses questions for the boards and managements of public and cooperative utilities to consider in their investigations of EIM. It focuses on utilities in the Southwest as WGG believes they are the next logical utilities to join the westwide EIM.

A PDF of the full report can be downloaded HERE.

——————————–

Balancing Market Opportunities in the West

How participation in an expanded balancing market could save customers hundreds of millions of dollars

Prepared for the Western Grid Group

October 10, 2014

AUTHORS

Paul Peterson

Spencer Fields

Melissa Whited

EXECUTIVE SUMMARY

The expansion of the California energy market to allow electric utilities from outside the California Independent System Operator (CAISO) footprint to participate in the real-time energy imbalance market (EIM) provides opportunities for substantial savings to ratepayers, improved reliability system-wide, and better integration of variable energy resources such as wind, solar, and hydro. These opportunities are available to all balancing authorities in the West, with systems adjacent to California the most likely initial participants.

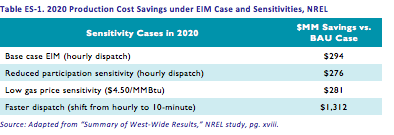

PacifiCorp joined CAISO in the October 2014 launch of this expanded balancing market. Nevada Energy is poised to join in October 2015. Other utilities in the West are presumed to be watching closely and considering the advantages to their customers. Several studies have documented the anticipated economic savings of a large regional balancing market. They include an early E3 study in 2011, a National Renewable Energy Laboratory (NREL) follow-up study in 2013, and individual assessments by CAISO, PacifiCorp, and Nevada Energy. Our review of those studies shows that an automated dispatch (such as a security-constrained economic dispatch, or SCED) with a larger quantity of available balancing resources can save $300 million dollars annually for balancing authorities in the West, not including significant reliability benefits and variable resource integration benefits. The production cost savings attributable to various EIM scenarios and sensitivities in the NREL study are presented in Table ES-1.

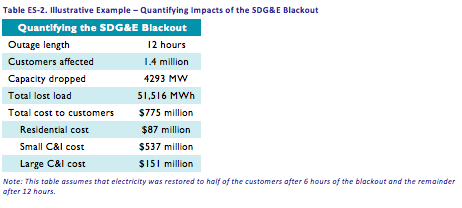

To develop a dollar estimate of reliability benefits, we reviewed the FERC staff report on reliability benefits, the NERC report on the September 2011 blackout that led to cascading load drops from Arizona to San Diego, a Brattle Group study, and a London Economics Institute (LEI) paper on the value of lost load. Based on these sources, we constructed an estimate of the cost of the September 2011 blackout in the San Diego area as an illustrative example. Even if an expanded balancing market only prevented a portion of the San Diego blackout, the savings to customers would have been in the hundreds of millions of dollars for just this one event. Table ES-2 presents an estimate of the total cost of the blackout to SDG&E customers.

In addition to balancing market savings and potential reliability savings, an expanded balancing market will provide benefits to daily operation schedules that will need increased flexibility to integrate larger and larger quantities of variable wind, solar, and hydro generation. Experience with variable resources and improvements in forecasting have demonstrated that variable resources are reasonably predictable over a 24-48 hour period. An expanded balancing market that covers a wider geographic area provides two immediate benefits in this area: (1) smoothing of the overall output of variable resources and (2) a wider pool of traditional balancing resources to accommodate small, short-term fluctuations.

With all these advantages, the opportunity to join an expanded balancing market seems too good to pass up. State commissions can take an active role in the process by asking balancing authorities under their jurisdiction to evaluate the benefits of an expanded balancing market for their customers. Utilities in Arizona, due to their proximity to California and Nevada, are probably good candidates for participation in the expanded CAISO balancing market launched this year.

——————————

To read the rest of the report: A PDF of the report can be downloaded HERE.

Comments are closed