Western Grid 2050: Contrasting Futures, Contrasting Fortunes

Carl Linvill, John Candelaria, Ashley Spalding

Aspen Environmental Group for Western Grid Group

(Download PDF of this sheet)

“The western United States is at a crossroads. Wise electricity sector investment choices will lay the foundation for a robust, competitive and healthy West for generations to come. Unwise choices will leave western businesses at a competitive disadvantage in the global marketplace, western consumers with higher electricity bills and westerners of all walks of life with an unhealthy environment.”

Executive summary

More than $200 billion will be invested in the electricity sector in the West by 2030. Investment is needed to replace aging generating units and respond to new energy demand from population growth, and economic expansion and electrification of the transportation fleet.

Western Grid 2050 analyzes Business As Usual (BAU) and Clean Energy Vision (CEV) development trajectories for the 11 western states and compares their economic, environmental, security and public health impacts. The report is intended to illuminate differences between alternative futures to emphasize the importance of making intentional policy and investment choices that shape the West’s electricity landscape.

DEVELOPMENT ALTERNATIVES

- Five trajectories were studied (BAU Base, BAU High Growth, CEV Low Demand, CEV Base Demand and CEV High Demand Case). Base data for the cases came from Western Electricity Coordinating Committee 2010 Study Cases, the entity responsible for coordinating and promoting bulk electric system reliability throughout the Western Interconnection, and were extrapolated beyond 2020 using BAU and CEV assumptions.

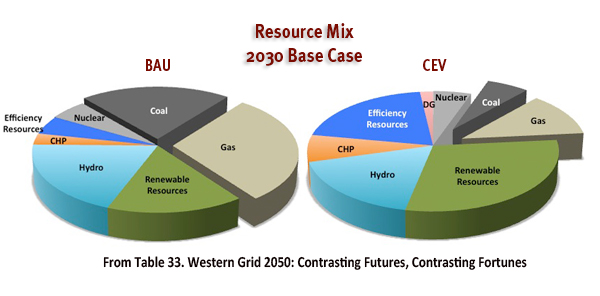

- In the BAU cases investment focuses on retrofitting and repowering coal generation and developing new natural gas-fired generation. Renewable generation is limited to meeting existing policy requirements, and efficiency measures and electrification of transportation are modest. Nuclear and hydro generation continue operating at current levels.

- Transmission operation under BAU is largely unchanged and each of the 38 Balancing Areas in the West meets its own reliability requirements with little regional cooperation. Regulatory and business model paradigms remain unchanged. (Chapter 1, Page 11)

- The CEV cases invest significantly in demand reduction (through energy efficiency, codes, standards and conservation) and distributed renewable generation is pursued aggressively. There is a transition completely away from conventional coal and natural gas generation is limited to meet carbon emission reduction targets. Large-scale renewable development fills the generation gap. Existing natural gas is re-purposed to ensure resource adequacy and reliability. Nuclear generation continues at current levels and existing hydro generation is de-rated gradually to 80 percent of current levels.

- Transmission operation under CEV assumes significant investment in advanced information, communications and control system technologies. The investments are assumed to support much greater grid flexibility, which is assumed to facilitate electrification of the transportation sector. Regional Coordination and cooperation among balancing areas increases across the west resulting in increased sharing and trading of resources and greater utilization of existing infrastructure.

- Generation sources differ dramatically between BAU to CEV cases by 2030. Refer to pages 48 – 50 for specifics on each case and its mix of coal, gas, renewable energy, energy efficiency, etc.

OUTCOMES

- Jobs: CEV development trajectories position the western electricity sector to become an engine of new job creation. The West can expect to generate more jobs per dollar invested under CEV cases vs BAU cases. CEV represents significantly more direct investment in high job-creating infrastructure development and operation than BAU, which requires considerable expenditures on fuel supply, a relatively low job creator. CEV jobs are high quality opportunities across a broad range of education requirements, salary levels and fields. Many are related to construction and installation, representing jobs that are inherently local in nature. Establishing a robust and long-term clean energy market can also enhance the West’s prospects for attracting manufacturing jobs. While CEV industries have a global manufacturing base, proximity to market is one significant factor in siting new factories.

- Global Competitiveness: A leading edge western electricity sector will make the West a producer and exporter of advanced technologies and create a competitive advantage for western businesses in the global marketplace. Roughly $2 trillion will be invested in clean energy globally over the next 10 years. Clean energy leadership nationwide would attract an additional investment of $97 billion to the U.S. over the next 10 years. A CEV trajectory will position the West to garner a significant share of that potential investment.

- Energy Reliability and Security: CEV reduces the use of coal and natural gas, decreasing the West’s exposure to expected continued fuel price increases and volatility as well as potential supply disruptions. CEV also enables electrification of our vehicles, delivering the energy security and price benefits of a transition away from foreign oil.

- Land Use: BAU requires less land than CEV for generation and transmission but uses far more land for fuel exploration and production. The highest large-scale renewable build-out case for 2030 under CEV represents approximately ½ of 1% of the land in the West.

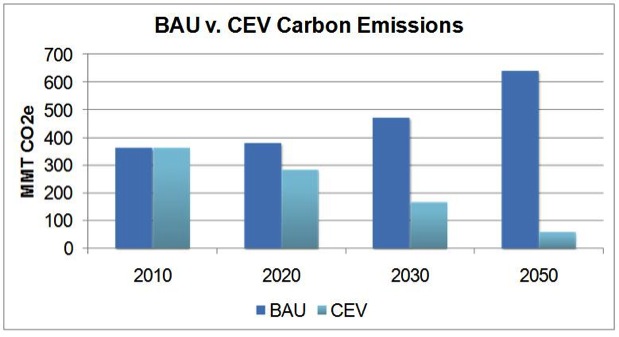

- Environment: CEV cases emit far less harmful pollution and carbon than BAU cases. By 2050 the CEV cases would also reduce electricity-related water consumption by more than half, saving 289-343 billion of gallons of this severely limited resource.

- Public Health: By transitioning away from coal, CEV cases can prevent hundreds of thousands of cases of premature death, heart attacks, asthma from particulate matter and neurological and development disorders from mercury exposure.

- Climate Breakdown: The CEV represents a “credible commitment” by the West to do its part to reduce carbon emissions therefore mitigating risks and costs associated with climate breakdown.

Figure 25: BAU vs. CEV

Carbon Reduction from Generation (page 56)

- Costs: Depending on the case, total BAU costs range from $12 billion less expensive to $46 billion more expensive than CEV for generation, transmission and demand reduction by 2030. By taking full advantage of energy saving opportunities, a CEV trajectory can be achieved at lower cost than BAU. Because BAU cases have higher fuel and carbon costs, CEV will only cost consumers more in the unlikely case that natural gas prices and carbon prices stay low for the next 20 years. The report identifies sources of BAU and CEV cost beyond those quantified that require further investigation.

- Grid Design: BAU and CEV futures imply a dramatic difference in how the grid will be operated and planned for decades to come. Today, over 90 percent of the region’s electricity comes from large central station fossil, hydro and nuclear plants. The existing system was built and is operated to accommodate large base-load plants that serve local markets. It is inflexible and limited in its ability to assimilate new technologies or facilitate regional cooperation and sharing of resources. The BAU development trajectories continue this design. The CEV trajectories require dramatic changes in design. These changes provide a more efficient grid with greater flexibility that allows for much greater regional cooperation and trading of resources.

- Regional Coordination: A CEV trajectory requires greater cooperation and coordination among utilities and the 38 separate electric balancing authorities across the West. These changes update the existing 30-50 year infrastructure and provide a more efficient grid with greater flexibility. It will allow for much more efficient and effective resource trading and will reliably accommodate both distributed and large-scale renewable technologies.

Western Clean Energy Advocates (WCEA) organizations have joined together in the Clean Energy Vision Project and endorse the findings of the report:

American Wind Energy Association (AWEA), Center for Energy Efficiency and Renewable Technologies (CEERT), Clean Line Energy Partners, Clean Energy Project, Defenders of Wildlife, Environmental Defense Fund (EDF), Geothermal Energy Association (GEA), Intertribal Council on Utility Policy (Intertribal COUP), Interwest Energy Alliance, Large-Scale Solar Association (LSA), National Wildlife Federation (NWF), Natural Resources Defense Council (NRDC), Nevada Conservation League (NCL), Nevada Wilderness Project (NWP), NW Energy Coalition (NWEC), Oregon Natural Desert Association (ONDA), Renewable Northwest Project (RNP), Sierra Club, Sonoran Institute, Southwest Energy Efficiency Project (SWEEP), The Wilderness Society, Utah Clean Energy, Vote Solar, Western Clean Energy Campaign, Western Environmental Law Center (WELC), Western Grid Group (WGG), Western Resource Advocates (WRA)